Why the Long Tail Matters: Rethinking Merchant Retention Beyond the Top 20%

In merchant services, there's a common stat that floats around: "80% of your revenue comes from 20% of your merchants." And yeah, that’s usually true. Those top accounts are high-volume, often managed directly by account teams, and naturally draw the lion’s share of attention. But here’s the thing—focusing exclusively on that top 20% can create blind spots that are easy to overlook.

Let’s talk about the other 80%

These merchants are often unmonitored, unmanaged, and unprotected. They’re not getting check-ins from account managers or special attention when their volume dips. Yet, collectively, they still make up 20% of portfolio revenue. That’s not insignificant. And when these merchants churn, it’s rarely just one at a time—it’s dozens, sometimes hundreds. The impact builds slowly and quietly.

Looking at it another way, the long tail of your merchant portfolio is where small issues turn into systemic loss. And in many cases, these are merchants who could have been retained with the right visibility and engagement at the right time.

This isn’t just about protecting existing revenue. It’s about identifying merchants who are quietly growing, those who could transition into the top 20% over time if given the right support. It's also about reducing portfolio volatility by broadening the foundation of healthy, active accounts.

Here are a few practical reasons to keep the long tail on your radar:

-

- Cumulative impact: While each merchant may bring in less revenue, losing dozens or hundreds adds up fast.

- Retention over acquisition: It's almost always cheaper to keep a merchant than to replace them.

- Early signals: Small merchants often show early signs of distress or dissatisfaction—if you know where to look.

- Growth potential: Today’s low-volume merchant could be tomorrow’s star account.

The point isn’t to stop paying attention to your top performers—it’s to make sure your portfolio strategy doesn’t end there. With the right systems in place, engaging the long tail isn’t just possible—it can be efficient, targeted, and measurable.

Visualizing the Risk

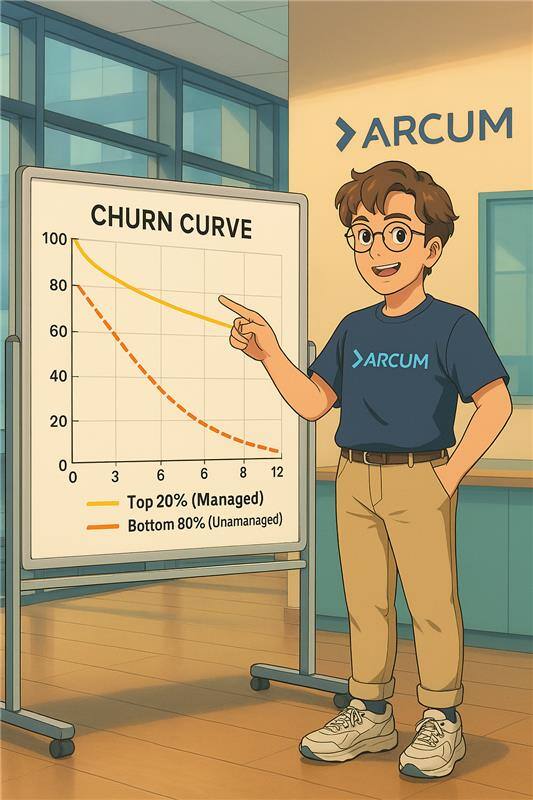

Take a look at the churn curve below. It compares the retention rates of managed (top 20%) versus unmanaged (bottom 80%) merchant accounts over the first year:

You’ll notice a steep drop-off in the first few months for unmanaged accounts. This is where silent churn tends to happen. For many portfolios, it’s not a matter of “if” but how much is being lost silently in the long tail.

Rethinking the value of your long tail might just be the unlock for more sustainable growth and a healthier portfolio overall.

Let’s start treating retention like the strategic lever it is—across the whole book, not just the biggest names.

Want to see how Arcum can help you reduce churn and drive retention? Let’s talk.